Let me first preface this by saying that my thoughts are with all those who may have lost money with Mt. Gox. While I did not have funds at Mt. Gox, I have felt the pain of investing in a young ecosystem that is on its way to adulthood, but not quite there yet.

It can’t be emphasized enough that Mt. Gox’s demise was not a Bitcoin problem; it was a Mt. Gox problem. I stopped using Mt. Gox this summer when it started to look like roach motel. Fiat withdrawals were being delayed, which was a pretty good indication to me that its assets and liabilities may not have been matching up. As they say, if it looks like a duck, walks like a duck…it is a duck. A failure of this sort is nothing new to financial systems, and the Mt. Gox failure appears to have been much more anticipated and absorbed by the bitcoin market than the collapse of Lehman Brothers or Bear Stearns was by fiat securities markets. To borrow from Warren Buffet, the market wasn’t all that surprised to learn that Mt. Gox had been swimming naked.

Mt. Gox’s closure marks the end of Bitcoin’s first wave of entrepreneurs and at the same time underscores just how far the Bitcoin ecosystem has come. 10 months ago, a lesser Mt. Gox issue cratered the price of bitcoin and the current scenario would have certainly ground the Bitcoin economy to a complete halt. Today, thanks to the hard work of many, the Mt. Gox “crisis”, as it’s been reported, has really been more of a speed bump on the road to mainstream maturity. Several other exchanges have stepped up and seamlessly shouldered the burden, and as a result, the price of bitcoin has shown remarkable resilience.

But the larger silver lining is how committed industry leaders are to building a trusted, secure and responsible future. The community recognizes that the way forward is not whistling past the graveyard but meeting the challenge to re-establish trust and continue to build trust, head on. On Monday, Coinbase invited Blockchain’s Andreas Antonopoulos (a competitor) to their offices to conduct an independent security review of their customer funds. Companies that take serious measures to be on the up and up will be the future of Bitcoin, those that don’t, are already fast becoming its history.

Mt. Gox’s closure continues to highlight the need for reasonable and responsible U.S. regulation that will both foster innovation and provide guardrails for consumers. Currently, the lack of clarity has pushed many Bitcoin companies and VC dollars offshore. US consumers have been forced to wire their money to Japan, the UK or Bulgaria, where there is little recourse for them if something goes wrong. Last months hearings in New York convened by NYDFS Superintendent Ben Lawsky were a big step in the right direction. People from over 117 countries tuned in; the world is watching. Two days ago, Superintendent Lawsky continued to voice his prior commitment to thoughtful regulation.

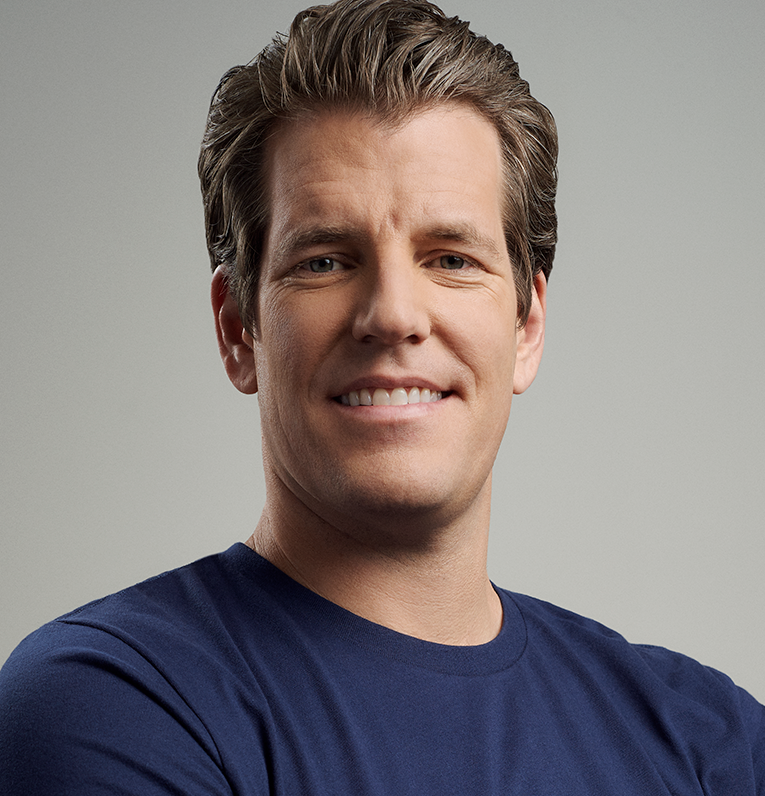

Bitcoin will get past Mt. Gox (it already has) and it will be stronger for it. Last Saturday, I spoke at the Oxford Union about Bitcoin with my brother Cameron and Mike Novogratz of Fortress. Mike made an interesting point. He said, “I like bitcoin a lot more today in the $500s than I did when it was here the last time on its way up.”

And in case anyone is wondering, I haven’t sold any bitcoin. In fact, I have taken this as an opportunity to buy more. Nothing worthwhile is built overnight, and nothing worthwhile comes without a struggle. My Bitcoin time horizon is in the years, there are some days I don’t even look at the price.